By Siromani Dhungana (with inputs from Yagya Banjade and Rashesh Vaidya)

As per the NRB’s latest data, the country has 31 commercial banks, 87 development banks, 80 financial companies and 21 micro-finance companies. The number shows that there is tough competition among banks and financial institutions (BFIs) forcing them to face multiple challenges. The major one is surely the capital base. The introduction of merger policy has created opportunities for banks to increase their capital base. At the same time, the BFIs are also going ahead with Initial Public Offerings (IPOs) to increase their capital base. In this issue, New Business Age tries to present an overview of how the Nepali banking sector is going about with mergers and IPOs.

The trend of announcing merger plans by the banks and financial institutions (BFIs) has gathered pace in recent months. According to Nepal Rastra Bank, a total of 28 banks and financial institutions (BFIs) have already merged with each other reducing the total number of BFIs by 15. Similarly, some 24 BFIs have already received Letter of Intent (LoI) to be merged with one other, and upon completion of this process, the total number of BFIs will reduce by another 14. And, other 12 BFIs have applied for the LoI. Once these too complete the process, the number of BFIs will be reduced by additional 5.

This shows that in spite of several weaknesses to implement monetary policy, Nepal Rastra Bank (NRB) has become quite successful in implementing its merger policy. Earlier, the central bank had announced packages of rebates, discounts, waivers and facilities to the BFIs opting for mergers. But now, the bankers themselves believe that merger has become compulsory for many banks which are suffering from the problem of low capital base and limited geographical coverage.

Similarly, a wave of Initial Public Offerings (IPOs) has started among the new BFIs. In the last Nepali calendar year that ended on mid-April, 20 BFIs issued IPOs, issuing shares worth Rs 5.6 billion. More offering such IPOs are in the pipeline. Though BFIs can increase their capital base also through Further Public Offering (FPO) of their shares, very few of them have opted for this route.

Need for Merger

Apparently, the universal objectives of the merger or acquisition are to consolidate the capital, reduce operational expenses, expand business and maximise profits.

However, in our case, mergers of three distinct natures now seem to be in the offing.

Firstly, relatively large institutions are planning to create a larger capital base so they could compete with global players who could potentially begin their operations here owing to WTO arrangements.

The second type of merger would be compulsive of sorts as the NRB has asked the BFIs belonging to the same business house to integrate without any “ifs and buts’’.

The third types are those who fear the complete meltdown if they fail to merge soon to consolidate resources, introduce corporate best practices and reduce expenses.

Consolidation is becoming increasingly necessary as banks are struggling to give returns to their shareholders. Almost all BFIs are eyeing mergers, and the number of BFIs will come down notably in the next three years.

However, bankers say more incentives are needed to speed up mergers, particularly between commercial banks. For example, they have been demanding decrease in corporate income tax to 20 percent from the current 30 percent for a merged BFI.

As there is no environment for increasing capital by issuing rights shares and bonus shares as that will not be enough to raise capital to the required level, finance companies have no other option than to go for a merger. Many finance companies have thought that’s it’s better to opt for a merger than to face action from the central bank for failing to increase the capital to the required level next year.

Also the shaken public confidence on towards banking institutions due to recent problems in the banking sector and their inability to give proper returns to their shareholders, has forced the BFIs to increasingly lean towards consolidation.

Consolidation is necessary also to increase the paid-up capital since the possibility to increase of paid up capital by issuing rights shares is very slim. Moreover, the size of loans being demanded by single borrowers has been increasing in recent years. So, BFIs having low paid-up capital cannot fulfill such demand.

Similarly, merger becomes an urgent need also because due to the terms agreed by Nepal while gaining membership of World Trade Organisation (WTO), financail services sector is open for foreign investors beginning 2010. So, foreign banks can open their branch in nepal. If big foreign banks open their branches in Nepal, the Nepali banks with small capital base may not be competitive.

The Journey of BFIs Mergers in Nepal So Far

The journey of merger of Nepali banks began nine years back. In 2004, Laxmi Bank merged into it Himalayan Saving and Finance Company (HISEF), and it was done according to the broad provisions of Company Act and Bank and Financial Institution Act (BAFIA). The then Narayani Finance and National Finance had merged to become Narayani National Finance following the same Acts. Similarly, Himchuli Development Bank and Birgunj Finance merged and became H & B Development Bank aalso merged under the same act.

That experience highlighted a need for special rules to govern this process. But was only in May 2011 that Nepal Rastra Bank came up with a special rule to facilitate mergers between BFIs.

When Nepal Rastra Bank (NRB) introduced the Merger By-laws in May 2011, many had still doubted whether Nepali banks and financial institutions (BFIs) would go for mergers as the concept was a relatively new for the country. That doubt seemed valid for some time. But soon a merger spree started among BFIs. Birgunj Finance and Himchuli Bikas Bank sought LoI from NRB in 2004 and completed their merger the same year becoming H&B Development Bank. The process gained memorandum after that. (See box for the list of BFIs merged so far.)

As the list on the box shows, most of the BFIs that have chosen to merge are development banks and finance companies merging with another institution of same category or with a commercial bank. However, latelycommercial banks too have started merging with another commercial bank. The recent such example is the merger process started by Bank of Asia Nepal and Nepal Industrial and Commercial Bank Limited.

Major Provisions of Merger By-Law

- ‘A’, ‘B’ and ‘C’ class financial institutions can merge into each other. ‘D’ class FI can merge with another ‘D’ class FI only.

- FIs that want to merge should form a separate merger committee and sign Memorandum of Understanding (MoU).

- The due process including MoU should be completed before applying to the Nepal Rastra Bank (NRB)for Letter of Intent (LoI). NRB should hold a meeting within 15 days of receiving LoI application.

- NRB decides whether to issue LoI or not after conducting discussions and detailed study of concerned institutions.

- Due Diligence Audit should complete within six months of receiving LoI from the central bank.

- The detailed factual report comprising assets and liabilities of concerned institutions should be submitted to the NRB.

- Copy of the decision regarding name, address and share ratio of concerned financial institutions should be submitted to NRB.

- Action plan of concerned financial institution including date of operation after merger process is completed should be submitted to NRB.

- Other documents as prescribed by the NRB should be submitted to NRB.

NRB can ask for merger if the following situation prevails:

- In case representatives of a family, business group, firm or company are found assuming posts in the boards of directors of two or more BFIs and/or their financial conditions remain unhealthy.

- If the non-performing loans (NPL) exceeded 5 percent of the total loan portfolio for 3 consecutive years.

- Increase in systematic risk (i.e. in a situation when a BFI seems likely to fail to meet liabilities).

- If independent operation of a BFI is causing negative impact on the banking system.

- If a BFI faces prompt corrective action (PCA) for three times or more.

- If NRB finds that merger of systemically important BFIs will strengthen the entire banking system.

Facilities for Merger

The new regulations have pledged relaxation on provisions for capital structure, shareholding limit for promoters, credit-deposit ratio, borrowings limit for promoters and deprived sector lending, among others.

If the merger causes increase in the shareholding percentage of any promoter beyond the stipulated limit, such promoters get five years time to bring down their stake within the limit.

Likewise, merged institutions are allowed additional three years to bring CD ratio down to the of 80 percent. Similarly, promoters get additional three years to bring their borrowing (loans) down to less than 50 percent of the total shares they hold in the merged BFI.

In a bid to lure BFIs to merger, the central bank has even promised a discount in refinance rate by one percentage point to the merged institution. It has also offered to lower penal rate on standing liquidity facility by half for three years in case two or more BFIs merged into one.

The central bank has also opened upgrading of fianancial institutions relaxed the restriction on upgrading of a BFI to encourage merger. A BFI can upgrade to higher category (category ‘C’ to ‘B’ and from ‘B’ to ‘A’) if the institution seeking to upgrade is formed through a merger).

The rules also promise to recommend to the government for exemption of taxes in case a BFI faces losses during the course of merger facilities include the time duration of using SLF will be expanded to 30 days from the existing 5 days for three years after completion of merger process. NRB can provide other facilities according to the need of the banks.

Challenges of Transition

Most of the consumers do not get sense of transition of banks merger because in an ideal case, all banking services continue to function normally even during the transition. ATM cards work, checks consumers write do not bounce and consumers will be able to get the all services.

However, banks face several problems during the transition. Among others major challenges of merger are as mentioned below:

1. Brand Name

The identity of the institution in the market is through the brand name. The image of an entity is joining with a brand image. So, the settlement in the brand name of the newly formed merged entity is essential.

2. Composition of board of directors (BoD) and shareholders

The major decision makers in any entity are the board of directors and the shareholders. If the disputes arise among these people, the performance as well as the future of the entity will be directly hampered. So, the number as well as the persons that should represent at the BoD should be settled in cool mind.

3. Structure of the new management team

The new merged entity comprises of the management team from two or more different entities. So, clear visions should be set-up for making the new management team which could handle the merged organization in coming days.

4. Employees Management

As the organization is merged, at the same time the employees also come together. The major assets any organization is human resources. So, if the merged entity can not handle properly the grievances of the employees, the situation of disputes may arise.

5. Ownership Division

The problem of division among the ownership might arise in the merged entity. The questions of shareholding as well as takeover of the share equity might create division among the shareholders.

6. Banking Software

Various types of software are being used by the BFIs for the smooth operation. Huge cost and efforts had been gone in maintain the software in an organization. But if the two different entities are using two different types of banking software, the problem as well as cost may arise in the settlement of the books of accounts.

Need of Separate Acquisition Law

Acquisition is, however, yet to come under the legal regime in the country. The central bank has said that it has been doing necessary preparations to introduce a separate legal mechanism on acquisition to encourage consolidation of the financial sector. Acquisition of financial institutions is difficult at present since there is no related legal provision, says CEO of Kailash Bikas Bank Krishna Raj Lamichhane who is also the president of Development Bankers Association.

NRB officials say that about half a dozen banks had held talks with the central bank about the possibility of acquiring regional development banks and finance companies to reach out to new areas. Acquisition is a relatively faster process as the challenges of merger such as it can be done once the buyer and the seller reach an agreement. Bankers say the introduction of legal provisions for acquisition will help bring down the number of BFIs in the country. The central bank needs to be careful while issuing new licenses and also the ability for smaller banks to withstand the economic crisis.

IPO Attraction

The Nepali investors have been showing very encouraging response to the IPO of the company, especially of commercial banks. The data of Securities Board of Nepal (Sebon) reveals that 22 companies have got approval for the IPO from mid July 2012 to till the mid May of 2013. Shares worth of Rs 5.78 billion came in the market during this period. Of the total 22 companies, eight development banks, eight commercial banks, three finance companies, one insurance company and one hydro-power company.

The Direction Ahead

The foremost challenge to the country’s banking sector in the realm of merger of banks is to create an environment where major financial institutions will go for merger voluntarily, says Upendra Paudyal, vice-president of Nepal Bankers Association (NBA).

The overall financial health of merged institutions has been found to be improved so far, he opines, saying the primary intention of the merger should be to strengthen capacity of concerned banks and financial institutions.

The policy taken by the Nepal Rastra Bank has resulted in positive signs since the market players in the arena of banks and financial institutions have saturated, adds Paudyal says. “Merger bylaws have played very crucial role in lowering the number of BFIs.”

But there is a question about the way forward of merger in the banking sector. The mathematical aspect has been highlighted so far by both the government and the BFIs, Paudyal says. It is cultural aspect which largely determines the success of merger. Sincere effort from all concerned parties is a must to make a merger journey a great success in the counry, he concludes.

In Nutshell

The first case of merger between BFIs in Nepal was the merger of HISEF Finance Ltd into Laxmi Bank Ltd in 2004

BFIs that have merged already

- Himchuli Development Bank & Birgunj Finance forming H&B Development Bank Ltd

- Narayani Finance & National Finance forming Narayani National Finance

- Nepal Bangladesh Bank & Nepal-Sri Lanka Merchant Bank forming Nepal Bangladesh Bank Ltd

- Kasthamandap Development Bank & Shikhar Finance forming Kasthamandap Development Bank Ltd

- Business Development Bank & Universal Finance forming Business Universal Development Bank Ltd

- Machhapuchchhre Bank & Standard Finance forming Machhapuchchhre Bank Ltd

- Global Bank & IME Financial Institution & Lord Buddha Finance forming Global IME Bank Ltd

- Infrastructure Development Bank & Swastik Merchant Finance forming Infrastructure Development Bank Ltd

- Annapurna Development Bank & Suryadarshan Finance forming Supreme Development Bank Ltd

- Vibor Bikas Bank & Bhajuratna Finance forming Vibor Bikas Bank Ltd

- Alpic Everest Finance & Butwal Finance & CMB Finance forming Synergy Finance Co Ltd

- Shine Development Bank & Resunga Development Bank forming Shine Resunga Development Bank

- Pashupati Development Bank & Udyam Development Bank forming Axis Development Bank Ltd

- Prudential Finance & Gorkha Finance forming Prudential Finance Company Ltd

- NIC Bank & Bank of Asia forming NIC Asia Bank Ltd (Process ongoing)

Letter of Intent (LoI) Received

- Premier Finance & Imperial Finance to form Premier Imperial Finance

- Royal Merchant Banking and Finance, Rara Bikas Bank & Api Finance

- Araniko Development Bank & Surya Development Bank

- Central Finance Ltd & Patan Finance Ltd

- Diyalo Bikas Bank Ltd & Professional Bikas Bank Ltd

- NDEP Development Bank & Hama Finance Ltd

- Siddhatha Development Bank & Public Development Bank Ltd

- Five Regional Development Bank to form One National Level Gramin Bikas Bank

- Shangrila Development Bank Ltd & Bagheshwor Development Bank

LoI In Pipeline

- Lalitpur Finance Ltd & Progressive Finance Ltd

- Sagarmatha Merchant and Finance Ltd & Reliance Finance Ltd

- Social Development Bank & Corporate Development Bank

- Vibor Bikas Bank & Kist Bank Ltd

- Manakamana Development Bank Ltd, Infrastructure Development Bank, Yeti Finance Limited & Valley Finance Ltd.

- Khadbari Bikas Bank & Birat Laxmi Finance

- Global IME Bank & Social Development Bank Ltd.

Merger Process Dumped

- Kathmandu Finance Ltd & Civil Merchant Bittiya Sanstha Ltd

Financial Indicators of the Merged Entities

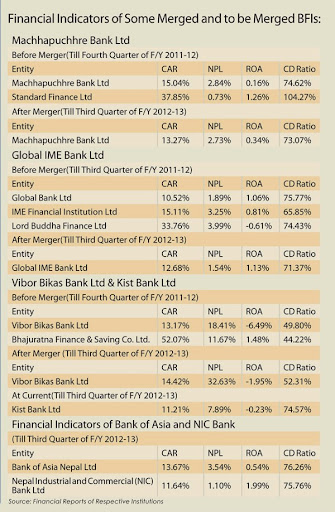

The major financial indicators of the merged entities have slightly improved compared to the pre-merger situation.

Machhapuchhre Bank Ltd (MBL) had a higher level of non-performing loan (NPL) before merger than of the Standard Finance Limited (SFL). The NPL of MBL was at 2.84 percent whereas; the NPL of SFL was at 0.73 percent. After the merger, the NPL of MBL stood at 2.73 percent according to the financial report for mid-July 2012.

The Credit Deposit (CD) Ratio of SFL was very high at 104.27 percent whereas, the ratio was at good level at 74.62 percent for MBL before merger. After the merger the CD ratio of MBL was maintained at 73.07 percent. But the Return on Assets (ROA) declined below one percent.

Among the three merged entities in Global IME Bank Ltd, the financial performance of Lord Buddha Finance Ltd was not good. Its Capital Adequacy Ratio (CAR) was very high at 33.76 percent. Similarly, the NPL and ROA of the finance company were at 3.99 percent and -0.61 percent respectively. The NPL of merged entity, Global IME Bank Ltd stands at 1.54 percent as of the third quarter report of the FY 2012-13. At the same time the ROA is at 1.13 percent.

Similarly, in Vibor Bikas Bank after merger of Bhajuratna Finance & Saving Co. Ltd. has a high level of CAR at 14.42 percent but at the same time the level of NPL has increased to 32.63 percent till the third quarter of the F/Y 2012-13. The ROA of the bank is also seen negative. It is at -1.95 percent.

Vibor Bikas Bank is again going ahead with a proposal of merger with Kist Bank Ltd. The NPL of the Kist Bank Ltd is seen comparatively lower than of the Vibor Bikas Bank. The ratio was at 32.63 percent and 7.89 percent for Vibor Bikas Bank and Kist Bank respectively as of third quarter of the F/Y 2012-13. Both the banks have posted the negative ROA during the third quarter of the FY 2012-13. Similarly, Vibor Bikas Bank has not been able to maintain the good level of CD ratio during the period.

Recently, Bank of Asia Nepal Ltd and NIC Bank Ltd have received LoI from NRB for merger. The banks have already announced a plan to publish their combined financial report of the fourth quarter of F/Y 2012-13 in the name of the merged entity, NIC Asia Bank Ltd. Both the banks’ indicators show that they are in a financially sound position. After the merger they are likely to emerge even stronger in the banking market.

Merger is a need of the entire financial system

What is the situation of merger in the banking and financial Institutions (BFIs)?

What is the situation of merger in the banking and financial Institutions (BFIs)?

The trend of merger in BFIs has grown lately. After the introduction of Merger Bylaws in 2011 by Nepal Rastra Bank (NRB), 22 financial institutions merged to become 10 within a year. This is very encouraging.

Why is there a need for merger in the financial market?

Financial institutions have mushroomed in the country, thanks to the liberal policies adopted by Nepal Rastra Bank in the past. Given the size of our financial system, the number of BFIs looks more than normal. Many of these institutions had invested in the real estate sector without any long-term benefits. NRB was forced to fix a ceiling on real estate investment by banks after a surge in the volume of nonperforming loans.

Investment by financial institutions in unproductive sectors caused a liquidity crisis in the market. These institutions also failed to maintain corporate governance. Financial institutions should be able to return money to depositors as required. NRB had introduced Merger Bylaws 2011 to improve the condition of financial institutions.

Why are there no expected improvements in merged institutions?

Merged organizations are much improved in comparison to single and troublesome financial institutions. The process of merger has helped institutions increase their capital base and ability to return the people’s money.

Can you briefly tell us the merger process?

Merger is a need of the entire financial system of Nepal. The share swap ratio is obviously an issue of tension in the pre-merger phase. NRB provides counseling services to all institutions which want to go for merger. The process is very simple. At first, the BFIs should take the special decision of merger thorough the General Meeting of shareholders. Then they should sign a Memorandum of Understanding (MoU) for merger. Then, after forming a merger committee, they should apply to the central bank for the Letter of Intent. NRB conducts interaction with concerned stakeholders and provides insights including strengths and weaknesses of the merging BFIs. If BFIs want to continue the merger process even after the interaction, NRB approves the LoI. Concerned financial institutions should approve new structure which will come into effect after the completion of the merger process.

NRB should always deal the entire merger process carefully because merger should not promote monopolistic business.

What are the post-merger complications? Does NRB intervene if complications arise in the post-merger phase?

Some minor complications are inevitable in the post-merger phase. Salary disputes, implementation of new structure and other managerial work create several complications. NRB provides the necessary assistance if the situation so demands. Similarly, the central bank may opt for positive intervention if the post-merger complications start to hurt the entire transactions of the concerned BFI.

Are the BFIs reluctant for mergers?

Definitely not. But merger is a complex process. Two or more institutions can opt for a merger when they develop a sense of mutual trust. Many chiefs have to agree to make one chief. Jumbo administrative committees have to be downsized. The present scenario of mergers is pretty exciting.

Is merger a less attractive proposition because of the low incentives for the same?

First, organizations should be aware about the merger process. They should be aware that merger is not for NRB but for them. This is because it is their responsibility to make the organization stronger and sustainable. Providing different incentives and schemes to organizations is like luring a child by giving them chocolates. It is unnecessary to entice them like that.

The incentives provided to the merging institutions have been discontinued. What about reintroducing these insentives to the institutions that will merge now ?

NRB couldn’t continue the facility because of the incomplete budget. As soon as we have a full budget, NRB will renstate these facilities. The central bank is committed to facilitate the merger process.

Where has NRB’s preparation regarding bylaws related to acquisition reached?

Legally, BFIs which want to acquire the stake of any other financial institution can do so. The only difficulty is that NRB does not have any specific guideline and legal provision to tackle the issue of acquisition. NRB, however, is very supportive if any financial institution wants to acquire the stakes of other institution.

Is NRB considering forced mergers?

NRB is not for forced mergers because there is a need for mutual bonding in order to operate the merged entity smoothly. But NRB might force institutions which are in miserable financial status and cannot improve the same over a period of time.

Initial Public Offering in Banking Sector

The capital market is a mechanism created to facilitate the exchange of financial assets with a maturity period of more than a year. It is a broad term embracing the buyers and sellers of securities and all the agencies that assist the sale and resale of securities.

The capital market is a mechanism created to facilitate the exchange of financial assets with a maturity period of more than a year. It is a broad term embracing the buyers and sellers of securities and all the agencies that assist the sale and resale of securities.

Capital market activities started in Nepal in 1937 with the issuance of the shares of Biratnagar Jute Mills Ltd. However, a more structured market activity started with the establishment of a stock trading mechanism in 1976 along with the establishment of the Securities Exchange Center. Enactment of the Securities Act and establishment of the Securities Board in 1983 gave the impetus for the development of capital market in Nepal in a more organized manner. In the early 90s after the success of the first People’s Movement, the government adopted liberal economic policies and opened up various areas to the private sector. This paved the way for the entry of private banks into the country’s financial market.

With the opening up of the economy, banks and financial institutions (BFIs) from the private sector have been in the forefront of making initial public offerings (IPOs). The IPOs of BFIs are also the most sought-after IPOs in the secondary market. In fact, most of the trading that takes place in the secondary market is that of the shares of companies from the banking and financial sector. So, this sector has played a major role in the development of our capital market., the number of companies listed at Nepal Stock Exchange (NEPSE) as of May 17, 2013 was 224 of which 29 are commercial banks and 142 development banks and finance companies. Besides, 68 per cent of the daily trade at NEPSE is of the shares of commercial banks. This shows that the secondary market in Nepal is highly dominated by the banking sector. Why is this sector so dominant?

There are various reasons. First and foremost is the licensing requirement of Nepal Rastra Bank (NRB), the central bank. NRB has made it mandatory for BFIs to issue their shares to the public. BFIs have to go for IPOs within two years of obtaining the operating license from the central bank. Besides, in IPOs, funds flow from the provider to the user. This means the contribution of IPOs to financing companies is direct in the sense that it provides them with additional funds for either starting a new business or expanding or diversifying the existing ones. This might not sound true for banking sector companies. However, IPOs fetch them funds which they can use to lend or to meet the various other requirements such as capital requirement set forth by the regulator. IPO also gives the public investors a partial ownership of the company and an opportunity to be represented at its board of directors. This representation of public directors in the board helps to bring about transparency and good governance at the higher echelon of the company.

When Janata Bank Ltd issued an IPO worth Rs 600 million last year, it was believed that the bank had ill-timed the issuance as the secondary market indicator, the NEPSE index, was bearish. Investors were pulling out of the secondary market and the merchant bankers related with the IPOs, too, were worried about the subscription. However, when the IPO closed, the issuance had been oversubscribed by 2.43 times. This showed that the investors still had confidence in the IPOs of commercial banks. The IPO of Janata Bank was followed by that of Civil Bank Ltd which issued an IPO worth Rs 800 million which, in turn, was oversubscribed by 6.38 times. Recently, Commertz & Trust Bank Ltd made an IPO worth Rs 600 million which was oversubscribed by 11.64 times. During the same period, IPOs of some development banks and finance companies were undersubscribed or even cancelled.

NRB has put a lot of emphasis on good corporate governance practices in the banking sector and banks are under constant supervision of the central bank. Barring a few, most banks have been giving good returns, in terms of cash dividend and bonus shares to their investors. The investors, too, have benefitted from a higher capital gain from the trading of shares of banks, compared to those of companies from other sectors. There is also a belief amongst the investors that commercial banks do not fail. This has boosted the investors’ confidence in banking stocks.

Both the government and the central bank have been persuading the BFIs for mergers in order to strengthen the banks and consolidate the growth of the financial sector. Some financial institutions have opted for merger and the effects of this will be seen on the market in the coming days. Though difficult, mergers will definitely strengthen the banks' capital base and enhance their operational efficiency through synergic effects. This, in turn, will attract more investors to banking stocks.

(The author is a Director at SEBON)

Problems of Merger

The country’s banks and financial sector witnessed a significant change with the introduction of merger bylaw by Nepal Rastra Bank (NRB), the central regulatory body of banks and financial institutions (BFIs). The bylaw has provided unique opportunities to BFIs to overcome the problem of capital inadequacy.

The country’s banks and financial sector witnessed a significant change with the introduction of merger bylaw by Nepal Rastra Bank (NRB), the central regulatory body of banks and financial institutions (BFIs). The bylaw has provided unique opportunities to BFIs to overcome the problem of capital inadequacy.

Nepal Rastra bank enacted merger bylaw in 2011 and the pace of merger have accelerated after that. The reasons of mergers among banks and financial institution is obvious, they want expand their presence in the market. Some major reasons of merger are as mentioned below:

Increase capital base: The reason of most of the mergers is that banks want to increase their capital base. The central bank has urged banks to enhance capital base to expand their services into the urban areas especially in the capital.

Expand services: Banking consolidation helps concerned institutions expand their services. For instance, merger provides opportunities of utilizing each other’s brand and public relation jointly. Banks and financial institutions can expand their services after increasing their capital base. Similarly, merger helps banks to increase investment capacity that will make them capable of investing in huge projects.

Implementing new and innovative ideas: Banking consolidation through merger will allow BFIs to explore chances of coming up with innovative ideas. Together, the banks and financial institutions can enhance their operation system and implement effective management.

However, the process of merging of banks and financial institutions is not free of hassles. There are basically two types of hassles to complete the merger process: i) external or created by the regulator and ii) internal or the managerial problems within banks and financial institutions.

At present, the central bank has made it mandatory to stop trade of shares after starting the merger process which, I think, should be changed. I do not see any logic and rationale behind this provision.

Similarly, the government does not provide any facility to the banks and financial institutions which want to be merged. I feel that the government should reduce corporate tax to 25 per cent from existing 30 per cent for five years after merger process complete. It is necessary because BFIs should invest huge chunks of money in managerial activities to complete the merger process. It is really challenging to ensure smooth transition and resolution of conflict likely to surface among the staff due to hostility, ego clashes or layoffs during the merger process.

It is a fact that the existing merger process between various financial institutions seem to be more forceful in nature. I do not mean that the Nepal Rastra Bank has put any pressure for mergers but the circumstances have made BFIs merge. I think the government should create an environment where banks and financial institutions voluntarily show their readiness to be merged.

(Writer is Chairman of Development Bankers Association and CEO at Kailash Bikash Bank)

Merger and Its Challenges

Business organizations can combine with each other in a various ways. One of the most common approaches is Mergers and Acquisition (M&A), which combine independent firms under common control. After unveiling a merger bylaw, the practices of M&A in Nepali banking sector has been increasing tremendously. Around two dozen BFIs merged each other and created 13 institutions. More than two dozen BFIs have got the letter of intent (LOI) to go for the merger. Even if merger has been practiced in the financial sector to cope the various issues, there has been no real academic effort to extensively appraise how employees are reacting, adapting and coping with the new realities in the post– merger period as well as how BFIs are achieving their business targets.

Business organizations can combine with each other in a various ways. One of the most common approaches is Mergers and Acquisition (M&A), which combine independent firms under common control. After unveiling a merger bylaw, the practices of M&A in Nepali banking sector has been increasing tremendously. Around two dozen BFIs merged each other and created 13 institutions. More than two dozen BFIs have got the letter of intent (LOI) to go for the merger. Even if merger has been practiced in the financial sector to cope the various issues, there has been no real academic effort to extensively appraise how employees are reacting, adapting and coping with the new realities in the post– merger period as well as how BFIs are achieving their business targets.

Furthermore, we should not forget that in achieving the objective of BFIs merger, quite a number of intrinsic risk factors may be involved both during and post merger period which should have to be address by regulators as well as by bank BOD and senior management level.

Literature says, merger that has been practiced internationally is not less challenging. Some inherent features of merger as well as some country specific problems add more challenges in it. In the past, tangible aspects (e.g. capital, raw materials, equipment etc.) were the major issues of merger. Now the scenario has changed, and intangible aspects (e.g., human capital, culture, knowledge, goodwill, brand etc) are emerging as key challenges.

We adopted merger strategy very lately; though it has more than 120 years long history internationally. Nepal dose not have separate Act about M&A, so there may arise some legal risk in the future. Today, large BFIs desire to acquire small financial institutions but we have no Acquisition provisions. M&A is significantly affected by the geo-political condition of the country. Present situation of our country is unfavurable for mergers because of the rise in concept of divergence and dissolution, which is a serious external threat for merger. Lack of specific Act and provisions regarding acquisitions and geo-political scenario are major challenges. Besides these, some challenges and problems are as follows:

- Top executives and top level management team may leave unexpectedly. When they leave the merged organization the expected synergy will be evaporated.

- Expected synergies evaporate also because of cultural differences. Research says only 23 percent of all M&A earn their cost of capital.

- Data migration plays vital role in the merger, sometimes this single task will be multi-time expensive than other factors of merger.

- Expenses get increased because of disposal of old stationeries, write-off provisions of duplicated branches.

- Power politics can be a major obstacle to the success of M&A.

- Agency problem is another key challenge of M&A.

- Who are going to leave from the BOD will be an anxious issue.

- It further creates anxiety while selecting CEO or top level management officials because the institutions undergoing merger have their own individual CEO or higher management authorities.

- Due Diligence Audit Report (DDAR) does not give accurate price of the institutions hidden contingent liabilities may get added which further enhance the challenge in the merger.

- Management of employee of duplicated branches is yet another high value expense occurred due to merger.

(Writer is Deputy Director at Nepal Rastra Bank. The views expressed here do not necessarily represent the views of NRB)