--By Rashesh Vaidya

The Insurance Board is pushing for mergers between insurance companies as the deadline for the companies to meet the paid up capital requirement comes nearer.Currently, 25 insurance companies are in the market. Of these, 17 are handling non-life and eight companies handling life insurance business while Rastriya Beema Sansthan is allowed to provide both life and non-life services.

In September 2011, the Insurance Board had directed life and non-life insurance companies to raise paid-up capital to Rs 500 million and Rs 250 million, respectively, by mid-July 2013 to enhance their shock absorbing capacity. The new capital requirement is 100 percent higher than what was required earlier for life insurance companies. However, it is 50 percent higher for the non-life insurance.

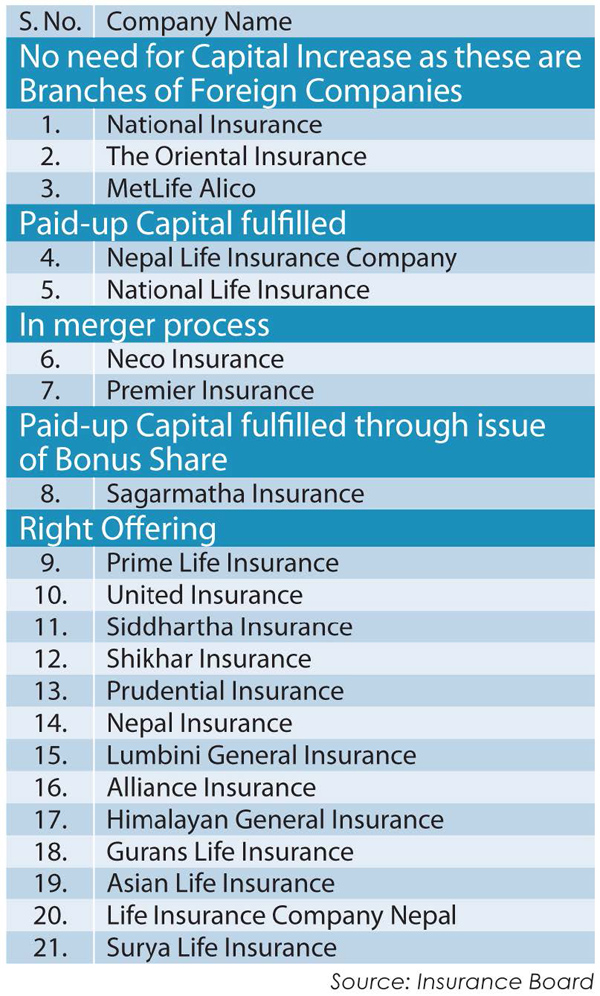

If the condition of new capital adequacy is implemented, only five of the total 25 companies, are capable to fulfill it.

Insurance Board provides various facilities to the insurance companies that to go for merger process. As per Insurance Company Merger Policy, 2013, the facilities provided are:

• One year of time extension to increase the capital to merged entities.

• A grace period of up to one year to right-size investment portfolio.

• Individuals, groups and institutional investors holding a stake of over 15 percent of paid-up capital in merged unit will be given a period of up to two years to make necessary changes.

• Management expenses incurred in the course of merger will be exempt from the regulator restrictions.

The insurance companies are also trying to fulfill the capital adequacy requirement from means other than merger. Twelve insurance companies are issuing right shares while one company is issuing bonus shares and another injecting additional capital from promoters. Two companies are on the process of merger. But remaining four companies have not made any plan for increasing their capital base.

Though the life insurance companies can fulfill their capital requirement by issuing right and bonus shares, non-life insurance companies might not be capable to complete such process within the deadline even if they started the process now. Thus, there is no option for them other than going for merger.

As per the new rule, the paid-up capital for non-life insurance companies has to be Rs 1 billion and for life insurance companies it is to be Rs 2 billion.

As of now, Neco Insurance and Premier Insurance are the only two companies that have decided to merge setting a deadline of mid-July to complete consolidation. Mid-July is the deadline within which the insurance companies are required to increase their capital to the minimum level fixed by the Insurance Board.

Upon completion, this will be first case of merger between non-life insurance companies in the history of Nepal. The two companies have obtained initial approval from the Insurance Board, the insurance sector regulator, to initiate the merger process. As of mid-April, Neco Insurance had a paid-up capital of Rs 121.27 million, while Premier Insurance had Rs 102 million. If the two companies are consolidated, the new company will have a paid-up capital of Rs 223.27 million, which means it will still have to raise additional Rs 26.73 million to meet the minimum capital requirement.

Premier had earlier tried for merger with Shikhar Insurance Company but could not succeed. Shikhar went on to fulfill the capital requirement by itself.

Similarly, United and Alliance Insurance Companies are also in discussion regarding the merger between them. Before this, United and Prudential Insurance Companies too had tried for a merger, but they too did not succeed.

Though the Insurance Board has directed to increase the capital base for both the life and non-life insurance companies, the provision will not be applicable for National Insurance, The Oriental Insurance and MetLife Alico as they have been operating in Nepal as a branch office of their respective parent companies.

| Criteria of Measures for Due Diligence Audit Report as per Insurance Company Merger Policy, 2013 • Net worth • Reserve Fund • Follow-up of Prevailing Laws • Investment Situation • Human Resource Management • Information Technology • Market Segmentation • Share Swap Ratio and Market Price per Share • Solvency Position • Claim Payment Capacity • Unfinished Risk Reserve Adequacy • Life Insurance Fund for Life Insurance Companies • Other necessary document as directed by the Board |