May 28: Total net profit of government-owned public enterprises has fallen by 1.21 percent to Rs 48.29 billion in the last fiscal year (2019/20) from Rs 48.89 billion in the previous fiscal year.

According to the report of ‘Annual Status Review of Public Enterprises 2021’ released by the Ministry of Finance on Friday, 24 out of 44 enterprises in existence earned a profit while 18 incurred losses. Other two public enterprises did not make any transaction, according to the report.

Government officials blame the fall in the net profit of public enterprises to a decline in their businesses due to the Covid-19 and the pandemic induced containment measures.

The impact of the Covid-19 is also reflected in their revenues, according to government officials. The review report, commonly known as Yellow Book, shows a 6.91 percent decline in total revenue of all public enterprises to Rs 460.39 billion in the last fiscal year. The combined revenue of public enterprises was Rs 494.59 billion in the previous fiscal year.

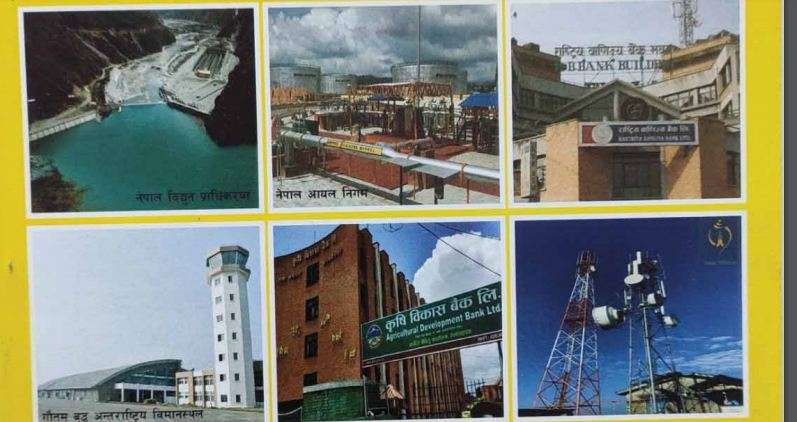

With a net profit of Rs 12.91 billion in the last fiscal year, Nepal Oil Corporation stood at the top of the list of five highest profit earners. Other four public enterprises were Nepal Electricity Authority (Rs 11.04 billion), Nepal Doorsanchar Company Ltd (Rs 9.75 billion), Rastriya Banijya Bank Ltd ( Rs 4.38 billion) and Agricultural Development Bank Ltd (Rs 3.33 billion).

The government received a total of Rs 14.9 billion in cash dividend from public enterprises, a jump by 48.87 percent of the return in the previous fiscal year.

Only five public enterprises were able to pay cash dividends to the government. Nepal Doorsanchar Company Ltd was the highest dividend payer to the government with its contribution of 43.82 percent in the total cash dividend. Nepal Oil Corporation’s contribution in the total dividend was 36.56 percent.

However, the return on equity ratio stands at only 4.88 percent.

The Yellow Book shows that the government’s investment has gone up by 11.74 percent in public enterprises to Rs 519.55 billion. Share or equity investment accounts for 55.52 percent (Rs 288.65 billion) of the total investment. The remaining 44.48 percent (Rs 230.89 billion) of the investment the government has made in these public enterprises is in the form of loans.

As the government has been financing big capital projects including hydropowergeneration and transmission projects, airports and drinking water project through public enterprises, the investment is on the rise, according to the report.