It is quite evident that Portfolio Management Services (PMS) are gaining popularity in the Nepali capital market in recent years. They are an attractive investment vehicle for high net worth individuals (HNIs) and institutions seeking customised investment strategies and management services. PMS providers create diversified portfolios tailored to each client's investment goals, risk tolerance, and preferences. This service is also beneficial for individuals seeking long-term investment discipline and potential risk management.

According to a report by MarketsandMarkets, the global portfolio management services (PMS) market is projected to grow at a compound annual growth rate (CAGR) of 14.7% from 2021 to 2026. The report also highlights the strong growth expected in the Asia-Pacific region. This projection indicates that PMS providers are well-positioned to meet the increasing demand for professional investment management services.

In India, the PMS industry, which caters to high net-worth individuals (HNIs), experienced a growth rate of approximately 14.5% last year. In comparison, mutual funds (MFs) saw a growth rate of 5.7% during the same period. As of December 2022, the assets under management (AUM) for PMS and MFs stood at ₹26.9 trillion and ₹39.9 trillion, respectively.

In Nepal, 29 different merchant bankers are licensed under the Securities Board of Nepal (Sebon) with AUM of Rs 25-30 billion. The growth of PMS has been impressive in recent years, particularly in light of market volatility and political uncertainty. These factors have contributed to an increased demand for PMS, with clients seeking the expertise of investment professionals who can guide them through turbulent economic times.

One of the key benefits of PMS is its ability to provide hassle-free investment options, providing clients with peace of mind when it comes to managing their investment. The ultimate goal of PMS is to maximise returns while minimising risk, and this is achieved through the knowledge and experience of investment experts who work behind the scenes. As such, PMS offers a reliable and efficient approach for clients to invest in the market and achieve their financial goals with confidence.

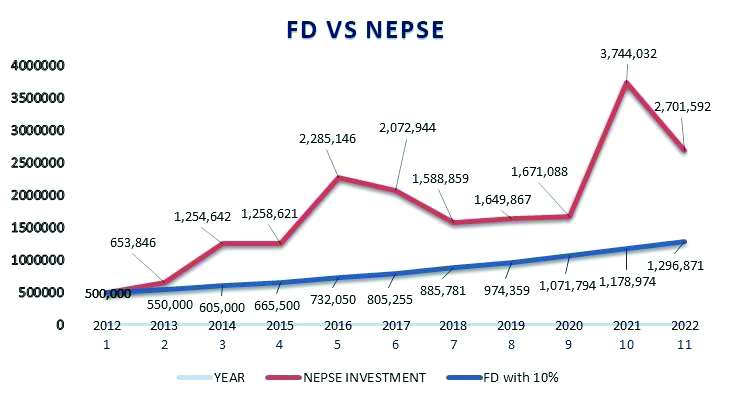

PMS providers offer a range of investment strategies, catering to diverse client preferences. These strategies include equity-focused portfolios, fixed income investments, and hybrid portfolios, holding a mix of asset classes such as stocks, debentures and fixed income instruments. PMS providers employ professional fund managers to monitor and manage the portfolio, ensuring optimised performance and risk management. Clients benefit from a high degree of customisation, as they have the flexibility to choose their preferred investment strategy, specific stocks or bonds to include in their portfolio, and determine their risk tolerance. This personalised approach allows clients to align their investments with their individual financial goals. Regular updates and reports on portfolio performance enable clients to make informed decisions. Navigating Long-Term Investment opportunity in market through PMS compared to Fixed Deposits (FD)

Sunrise Capital, as a pioneering institution in the merchant banking industry, has attained an impressive PMS growth of 25.72% in comparison to the Nepal Stock Exchange (Nepse) benchmark. This is attributed to the investment team's extensive market knowledge and the invaluable support of a team of expert researchers, which has consistently delivered impressive returns in the past, even amidst challenging times, outperforming the market.

In a bid to enhance the value proposition of investment options available in the Nepali capital market, Sunrise Capital recently introduced a globally recognised product, the Sunrise SIP PMS. This innovative offering blends SIP (Systematic Investment Plan) and PMS, presenting them in a single product. Sunrise Capital is confident that this revolutionary product will be a game-changer in the Nepali capital market and emerge as a highly successful investment option.

(Nishant Dhakal is an Equity Research Analyst in Sunrise Capital)