The recent curbs introduced by the government to control the property market saw enthusiasm dampen in the real estate sector. The question now is, what lies ahead?

--BY KRISHANA PRASAIN

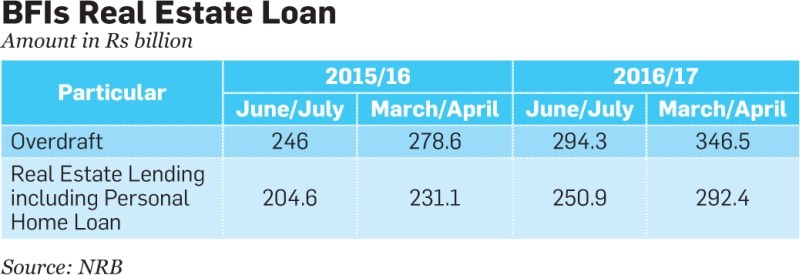

Real estate transations, which had been reaching normal levels after being hard hit by the twin shocks of the earthquake and border blockade of 2015, have come to an abrupt halt following the central bank’s policy to further tighten BFI lending on real estate and home loans.

The slowdown started in February when Nepal Rastra Bank (NRB) in its mid-term review of the current FY’s Monetary Policy capped bank financing on real estate and home loans to 25 percent of their total lending portfolio blaming it as one of the factors for the credit crunch which has gripped the Nepali banking system since late 2016. Citing lending for real estate and homes as ‘unproductive’, the banking regulator reduced the maximum limit of personal overdraft loans to Rs 7.5 million from the earlier Rs 10 million.

NRB’s decision has affected real estate entrepreneurs and home buyers alike. The interest rates on real estate and home loans have made buying residential houses more difficult and due to the tightening in the policy, developers are unable to sell houses and apartments built at huge cost and investment.

The National Shelter Policy, 2012 has projected that around 1,364,000 residential housing units are required in urban areas with around 900,000 new constructions by 2023 to fulfill the demand for homes in the country. According to the Nepal Land and Housing Developers’ Association (NLHDA), out of the total demand of homes, 2.26 percent is being fulfilled by housing developers while units constructed by the private land owners cover a whopping 97.74 percent at present.

“The demand for homes stands at 40,300 units annually. However, the supply is largely insufficient,” points out Om Rajbhandary, Executive Chairman of Brihat Group. Rajbhandary who is the executive committee member of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI) and chairperson of FNCCI’s Urban Development Committee views that the government policies have discouraged new entrepreneurs from entering the sector. “The construction and delivery of housing units is low at present as few people are interested in this sector,” he says.

Rajbhandary sees the real estate business as a cyclical. “Ups and downs are a usual occurrence in this business as it is impacted by factors including changes in government policies, monetary policy, issues related to labour and price of land,” he shares.

Contradictory Views

The debate over investment in the so-called ‘productive’ and ‘unproductive’ sectors has gathered momentum in recent years. The government and authorities such as NRB have been stressing on the need to discourage investment in sectors such as real estate and automobile which they term as ‘unproductive’. Rajbhandary sees this debate as unnecessary as the Industrial Enterprises Act has categorised the real estate and housing sector as an industry which is also placed among the sectors of national priority. “A state of confusion prevails in government regarding the treatment of the business sectors,” he says.

Rajbhandary says that the sector has been providing employment opportunities to a large number of Nepalis and also contributing to the growth of the Nepali manufacturing sector by utilising construction materials including cement, iron rod, bricks, paints, wires, pipes and other products which are mostly produced in the country. “Given this fact, how can the real estate and housing business fall under the non-productive sector?” he questions.

“Not only this, the real estate sector supports other industries with forward linkage as people buy items such as furniture, carpets, electronic equipment and various other household goods when they shift homes,” he adds. Rajbhandary informs that more than 200 industries related to the real estate sector are operational in Nepal at present. “It is among the industries that have been contributing to stop capital from leaving Nepal. I don’t understand why such a sector is being called unproductive,” he states.

According to entrepreneurs, while the average cost of building a home is Rs 7 million at present, Rs 2.4 million is spent on construction wages. “Around Rs one billion is spent in wages alone in the housing industry,” he informs.

Despite the rise in wages, developers have been reeling under the shortage of manpower. “Labour shortage is among the major problems the industry is currently facing,” says Kapil Adhikari, Assistant General Managers of CG Developers. According to him, it has become quite hard for companies to find both skilled and semi-skilled labour as a large number of Nepali workers have gone abroad.

Post-quake scenario

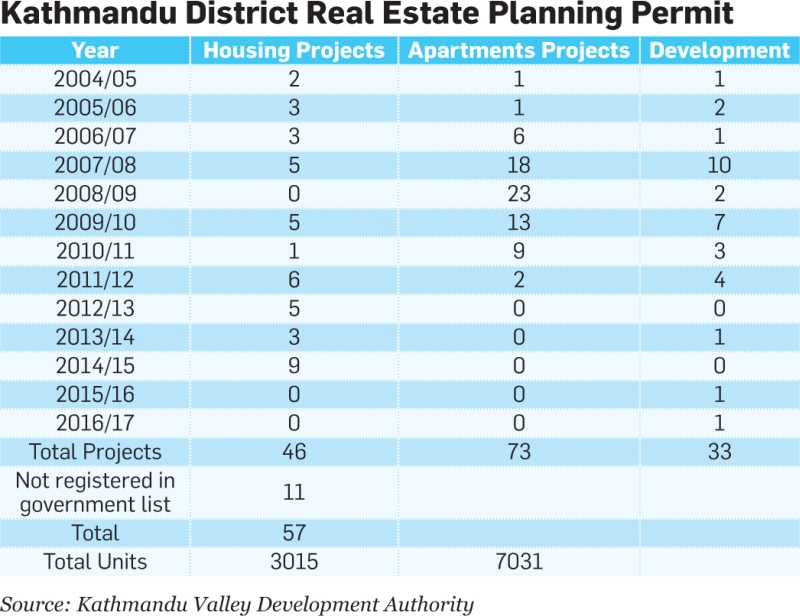

Before the earthquake, 93 housing projects were registered in Kathmandu and Lalitpur districts. Among them, 57 were registered in Kathmandu and 36 in Lalitpur. A total of 5,690 housing units were registered in the two districts. Similarly, around 600 housing units have been added after the quake.

Likewise, a total of 105 apartment projects have been registered in Kathmandu and Lalitpur. One apartment project was registered in the capital valley after the earthquake. “Around 19,000 housing and apartment units have been registered in Kathmandu and Lalitpur,” says Rajbhandary.

Currently, there are a dozen major housing companies in the country. CE Construction, Brihat Group, Comfort Housing, Downtown Housing, Civil Homes, CG Developers, Green Hill City, Westar Residency are the prominent names in the Nepali real estate and housing sector.

Zero Apartment Registration

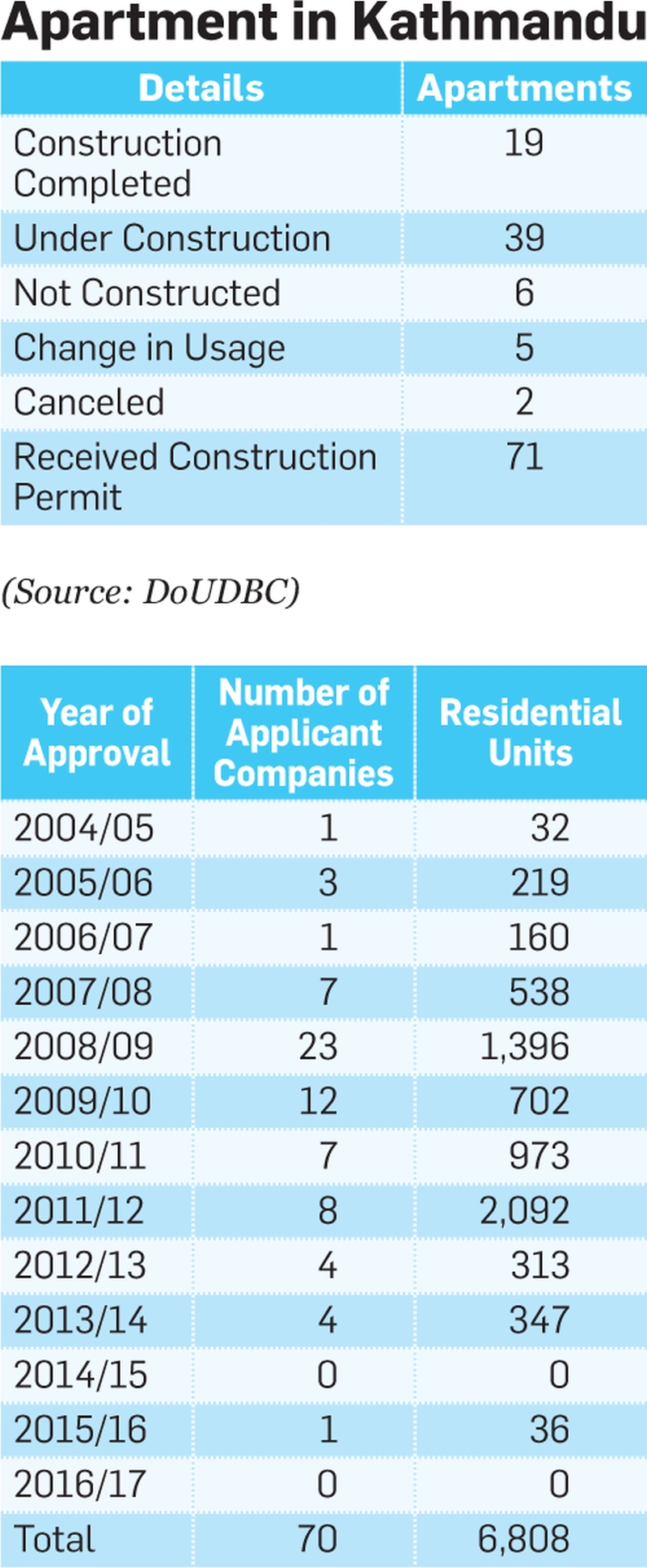

The apartment business which had seen stellar growth in the last decade is among the businesses most affected by the earthquake. Despite the fact that most of the apartment buildings were unaffected by the devastating shocks, the mentality of general house buyers towards apartments still remains negative primarily due to the fear of living in high rise buildings. “It takes around six months for the general people to nomalise their lives after a massive natural disaster. Nevertheless, Nepal faced severe disruptions due to the Terai stir six months after the earthquake which sharply slowed down activities in the housing and apartment business,” says Rajbhandary. Prior to that, the apartment business had also witnessed a steep slowdown following NRB’s steps to tighten the flow of money into the real estate sector in 2010.

According to the Department of Urban Development and Building Construction (DUDBC), only one apartment project has been registered between FY 2013/14 and FY 2015/16. Similarly, apartment projects that have already received construction permits have also not started the construction work, whereas some projects have even been cancelled. A total of 71 apartment projects received construction permits from FY 2004/05 to FY 2014/15. Among the projects, 19 have already been completed while 39 are under construction.

Real estate and housing developers argue that the implementation of managed urbanisation that successive governments have been stating over the years only rests in paper. The concerned authorities do not have specific strategies and plans to implement the policy which would also help in the betterment of the real estate business, they say.

Entrepreneurs seek facilities including tax exemption to home buyers, subsidised interest rates for first-time home buyers on bank loans and income tax holidays that can help the real estate business as well as customers.

Apartment as Alternative

With the increasing population, the availability of land in the urban areas has shrunken rapidly over the last one decade leaving apartments as the only option for housing purposes. Entrepreneurs stress that the horizontal management of the population is the best way compared to the vertical option and apartments are cost effective as well. “Though the earthquake frightened people off from staying in high rise buildings for some time, the psychology among the prospective home buyers has been slowly changing,” mentions Gaurav Agrawal, Managing Director Sunrise Developers. “The recession in the apartment sector seems to be easing as business has been gradually picking up since the start of 2017,” he says.

Residential Units Becoming Affordable

Various factors such as the rising price of construction materials, design of houses and higher wages of labourers contribute to the increasing cost of construction of residential homes. The cost over the last two years has further moved upwards as people are more concerned about the level of earthquake resistance of the structures. Builders nowadays have been designing and building homes that can withstand powerful earthquake shocks.

The average cost of constructing a two storey residential home in the Kathmandu Valley, for instance, is around Rs 7 million. Nonetheless, just two kilometres from the Ring Road, a well-furnished and facilitated residential home built by housing developers can be owned for the same amount.

Kapil Adhikari, Assistant General Managers of CG Developers says that the price of the residential homes built by his company ranges from Rs 35 million to Rs 55 million. Similarly, the price for an apartment unit in the capital valley starts from Rs 7 million going up to Rs 20 million. Gaurav Agrawal of Sunrise Developers informs that the apartments constructed by his company are available from Rs seven million to Rs 20 million.