The Nepal Stock Exchange (NEPSE) Index surged 2.71 percent, or 75.84 points, to close at 2,870.63 on Thursday, July 17—the first trading day of fiscal year 2025/26.

This marked the sharpest single-day gain since October 1, 2024, when the index had jumped 4.57 percent. A comparable rise was last seen on March 2, 2025, with a 2.67 percent uptick.

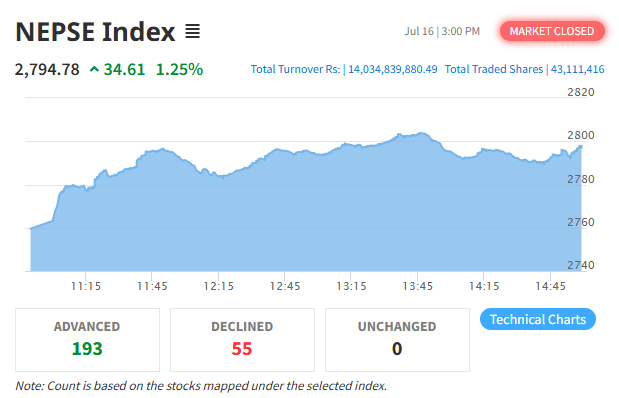

The latest rally follows the monetary policy announcement for the new fiscal year last Friday. The week began on a bullish note, with the index gaining 1.06 percent on Sunday amid strong interest in banking and microfinance stocks. After dipping 1.27 percent on Monday, the market rebounded 1.26 percent Tuesday and rose another 1.25 percent Wednesday.

Investor confidence remained strong, with Thursday’s daily turnover exceeding Rs 16.59 billion—up from Rs 14.03 billion the previous day. This was the highest turnover since August 27, 2024, when trading had surpassed Rs 18.64 billion.

A total of 38.53 million shares were traded across 141,434 transactions—slightly lower in volume but higher in trade count compared to Wednesday’s 43.11 million shares and 99,505 transactions.

All major sub-indices posted gains: the Sensitive Index rose 2.29 percent, the Float Index 2.62 percent, and the Sensitive Float Index 2.26 percent.

Out of 249 listed companies traded, 240 closed higher while nine declined.

Trade Tower Limited (TTL) hit the upper circuit and led the gainers with a last traded price of Rs 402.70 per share. Shuvam Power Limited (SPL) and Three Star Hydropower Limited (TSHL) also surged 9.99 percent each.

On the losing side, NIBL Stable Fund (NIBLSTF) fell the most, down 7.58 percent.

Nepal Reinsurance Company Limited (NRIC) topped the turnover chart with transactions worth Rs 844.27 million, followed by Butwal Power Company Limited (BPCL) with Rs 606.87 million, and Radhi Bidyut Company Limited (RADHI) with Rs 567.49 million.

All 13 sectoral indices ended in the green. The ‘Others’ Index led with a 5.09 percent gain, followed by the Investment Index (3.17%), Life Insurance Index (3.14%), and Hydropower Index (3.04%). The Mutual Fund Index posted the smallest increase at 0.04 percent.

Total market capitalisation rose to Rs 4,783.37 billion, up from Rs 4,656.99 billion the previous day.