August 27: Bankers believe that the reason for the decrease in the loan account of ‘B’ and ‘C’ class finance companies is the mergers and acquisitions of finance companies and development banks by commercial banks. There had been a merger between Gandaki Bikas Bank and Mega Bank some time ago. In addition to that, Kumari Bank and Deva Bikas Bank have also merged and started integrated transaction.

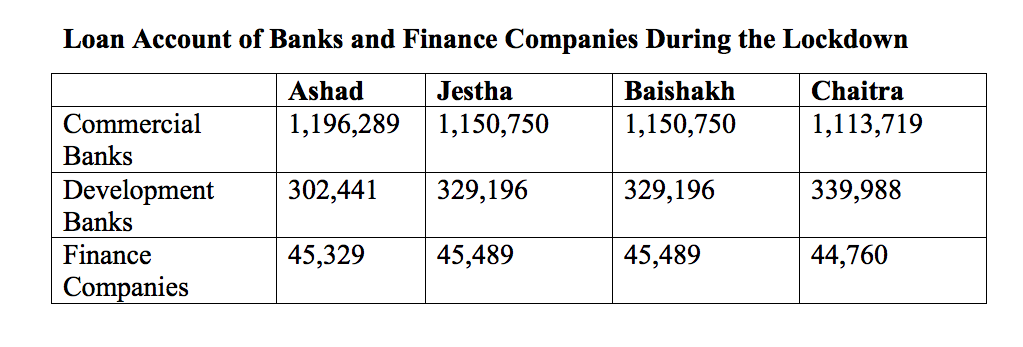

Commercial banks, which were not able to flow any new credit in the last 3 months (Chaitra, Baishak and Jestha) have given more than 45 thousand loans in Ashad (mid-June to mid-July). The total number of loans given by the 27 commercial banks was 1.15 million at the end of Jestha (mid-June) whereas it became 1.19 million by the end of Ashad (mid-July). However, the number of loans given has decreased for development banks and finance companies in the same period of time.

According to the data from Nepal Rastra Bank, the total loan account of the 20 development banks has decreased by 26,755 in the month of Ashad. The account that totaled 329,000 in Jestha (mid-May to mid-June) has become 320,000 in Ashad (mid-June to mid-July). However, Pradhyumna Pokharel, the senior vice-president of Nepal Development Bankers’ Association, says that the loans of development banks haven’t been transferred by much to commercial banks. According to him, the mergers and acquisitions between development banks and commercial banks is the reason for the decrease in the number of loan account.

The loan account of the ‘C’ class finance companies has also declined. The loan account of the total 22 finance companies has decreased by 160 in the month of Ashad (mid-June to mid-July). The loan account totaled to 45,489 in the month of Jestha (mid-May to mid-June). Saroj Kaji Tuladhar, the president of Nepal Financial Institutions Association, claimed that some of the debtors have moved to commercial banks because of the low-interest rate loan schemes introduced by the commercial banks due to the high liquidity in banks.

Tuladhar, who is also the CEO of Goodwill Finance, said that the interest rates on loans range from 10 percent to 15 percent in finance companies. However, commercial banks are competing for debtors by stating their interest rates as low as 7 percent. He added that some debtors have made a prepayment of their loans because of the lack of business due to the extended lockdown.

“Some debtors have searched for cheaper interest rates and swapped their loans. Some of them have paid off their loan using the money they have. There have been no new applications for loan. Therefore, the loan accounts of finance companies have decreased,” he said.

The interest rates on loans had decreased by about 2 percent after the banks implemented a single digit base rate from Ashad (mid-June to mid-July). They have also brought schemes that provide a discount on the interest of loans as a relief for those affected by coronavirus. Bankers claim that despite the decline in the interest rates due to the high liquidity, the credit flow has improved a bit. Commercial banks had distributed a loan of Rs 86 billion between mid-June to mid-July last year. The credit flow of the commercial banks was negative during Baisakh and Jestha (between mid-April to mid-June) because of the absence of the flow of new credit.