Aaron Capital, Inc., USA (www.aaroncapital.com), a global middle-market investment banking firm headquartered in the USA, specialises in a wide range of services including mergers & acquisitions (M&A), joint ventures and licensing, global cross-border alliance transaction structuring, valuation and fairness opinion, and corporate restructuring, among others.

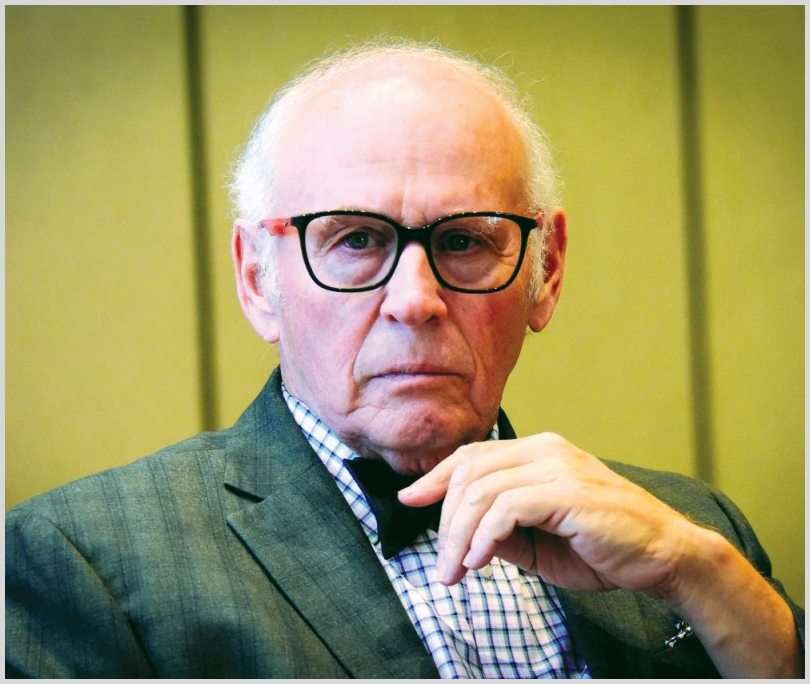

Chairman of Aaron Capital Inc, David S. Wolfe, along with his leadership team recently visited Nepal to explore the opportunity of investment banking business and also set up a dedicated fund focused on travel, leisure and tourism in Nepal along with facilitating the inorganic growth for startups and middle-market players. New Business Age met with Wolfe to talk about Aaron Capital and its possible engagements in Nepal. Excerpts:

Please share with us what was your visit to Nepal for?

During my visit, I met businessmen and officials of the central bank. I spoke about the opportunities we can bring here, and I spoke about the options and alternatives available with us on innovative financing of projects in Nepal. It may not be a very popular thing at first. To bring corporate America here, it should be the case. We only do things one way in Aaron Capital--the right way. If we think someone is little on the edge, we are out. During my visit here, I met a lot of influential people who would come to me and say, "I want to do business with you." We will provide support on healthcare, hospitality and other allied sectors here which I am unable to disclose at this time. It will be very big, and it will make news in the coming days.

What are the potential scopes of engagements for your company here in Nepal?

Typically, our engagement looks like JVs, M&As, financing and capitalizations and recapitalisations, leveraged buyouts, corporate divestitures and corporate restructurings. We are in the capital market too in the US, but not here in the subcontinent which we are planning to come at some point of the time. So, the typical engagements here would be in the areas of joint venture, buy-side and sell-side transactions in mergers, and capital raising for the time being. For a few very big companies, they need some transformation and we can help them to steer on the right path. In terms of sectors, we are looking at healthcare, education, business processing services, technology, real estate, leisure tourism and hospitality and banking and financial institutions. It's not what you know sometimes, it's whom you know. We are very connected in these areas and we know the players. When you know the players and they trust what you do as a bank and business, the people with whom you do business will trust us. We are going to be very careful and selective with the people and businesses that we deal with.

Our upcoming service will be related to healthcare or the technology related to fintech and medical devices. We are a very good banker for that. We can identify a good business very quickly to deploy capital. In Nepal, there is a problem of remoteness. So, we are bringing some technology to the hospitals or healthcare services here.

Based on your interaction with business leaders and other stakeholders, what was your impression of Nepal's investment climate?

I would say it's as aggressive as it can get. They are hungry for relationships and current businesses are looking for expansion. There are only 30 million people here. It's a limited amount. That's why I am recommending them here to build a tax haven. The tax haven does not cost them anything. Nobody has done it. So, it's a perfect spot in Asia. They [investors] can come from Global Countries and they will get a little bit of tax holiday. You are a small country and what do small countries do? Whatever they would have to do to survive. There are wonderful opportunities in the world right now. Nepal needs to take the advantage of all the opportunities that it could, and you can be a small player. Nepal is ripe to do what we do.

But many investors and business leaders also cite rampant corruption, bureaucratic red tape and obstacles that are discouraging investment here. Are such issues going to be barriers to investment?

I think you are a democracy. It takes time to come up with structured formats and the results will follow up with time. It is important that the results come up fast so that the investment climate becomes more ambient and conducive for foreign investors. We are sure the country is progressing on those lines.

There are concerns about the Covid-19 pandemic slowing down investment. As the chairman of an investment banking firm, what is your assessment?

I don’t see things that way. If you dam up a river without letting any water go for two years, what happens when you open the dam? It floods. So, that is what's going on. Nobody should count out Nepal because it is a land of entrepreneurs and smart people. It was a pleasure talking with people here. Every country is coming out from Covid-19. There was nothing good that came out of Covid-19, but there were some positive things. We became sensitive to our health. It brought awareness on what communicable diseases could be. We are not 100 percent protected yet. The virus is going to be here for a long time. You have to live on. You have to move on. You have to protect your families.

Are you going to finance projects in Nepal in the days to come?

Good projects will always find good money. There is more money than the projects. If you have a unique idea and thought process, you will definitely get financing opportunities from companies like us which have a global outreach. In terms of impact from the Covid-19 pandemic, there are always some business directional changes that take place anywhere in the world. For example, when a lot of hotels in Nepal closed due to the pandemic, a few of them converted into nursing homes. They converted their hospitality services to hospital services. Covid-19 has induced such directional changes in the businesses. We, as an investment banker, just wait to see. We don't run somebody's business, nor do we become emotional toward their business. We only support them and facilitate the gap in the strategy on the financial side.

Our specialties are healthcare, real estate, hospitality and technology. Our specialty is particularly on hospitality where we deal with all major hotel chains in the world. We also do a fair amount of corporate finance when the parent company needs to reposition or restructure itself.